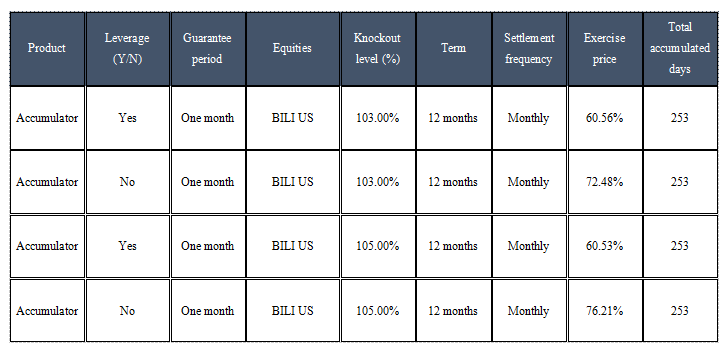

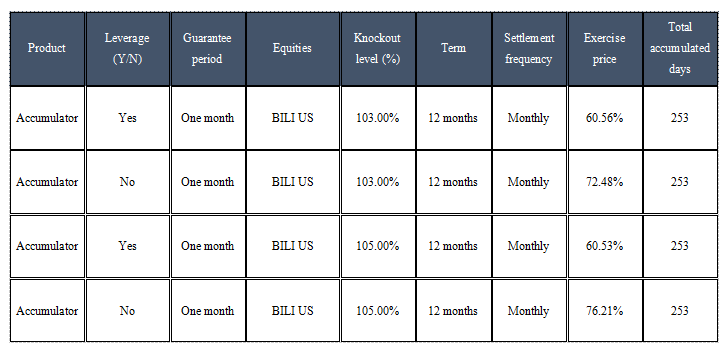

Take the quotes of Bilibili (BILI US) for example:

Characteristics:

-

An accumulator contract, in fact, is a contract of a portfolio of forward contracts, which allows investors to buy underlying securities at fixed prices and in a fixed time.

-

For an accumulator contract, the buying price (exercise price) generally is lower than the current market price.

-

An accumulator contract can contain cancellation clauses. With the daily closing price as the triggering point, when the market prices of underlying securities are higher than the cancellation prices at closing, the contract will terminate.

-

Leverage clauses: When the market prices of underlying securities are lower than the exercise price, investors need to buy leveraged times of the securities at a fixed time at the exercise price till the end of the contract.

-

Clause for purchasing a guaranteed number of equities: If the cancellation clause becomes effective within the guarantee period, investors can still purchase a guaranteed number of equities at the exercise price. The guaranteed number of equities = days of the guarantee period x number to be purchased daily.

Main risks:

-

Liquidity risk—There is no secondary market, so the exit cost is high.

-

Investment risk—When the market develops toward an unfavorable direction, investors still need to purchase the preset number of equities at the exercise price, which might lead to a major loss.

-

Leverage risk (if applicable)—This risk might raise losses.

-

Cancellation clause risk—The expected profit of investors may be restricted by the cancellation clause.

-

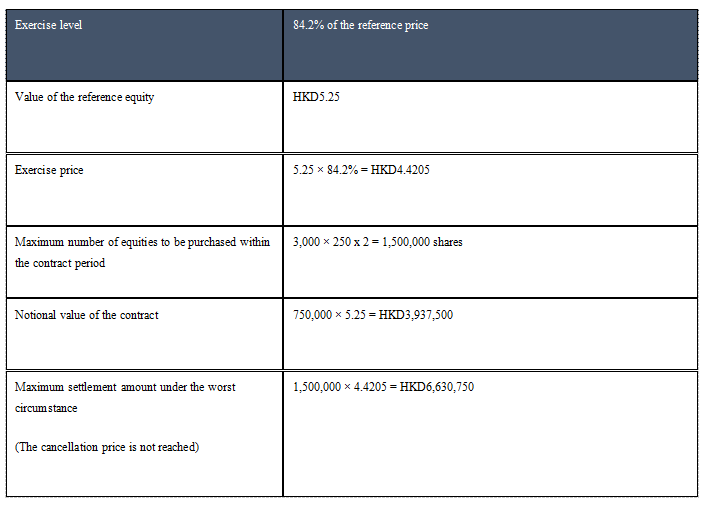

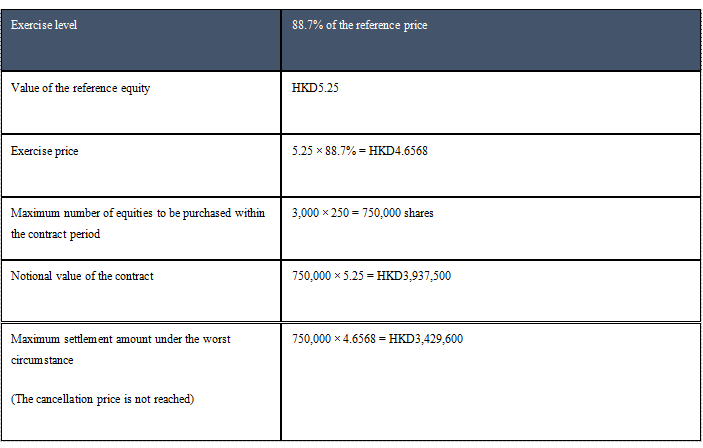

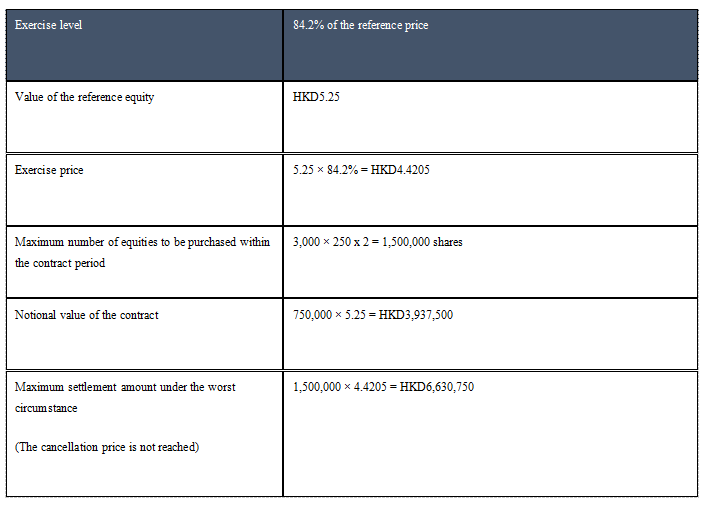

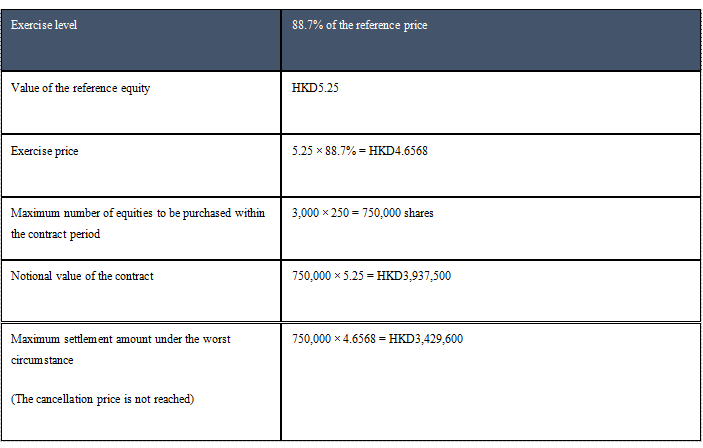

An investor intends to purchase a one-year ordinary accumulator contract of ABC Co., Ltd. with a one-month guarantee period. The cancellation price of the contract is 103% of the value of the reference equity. The accumulator is settled monthly. A total of 3,000 shares are traded daily. Suppose there are 250 trading days per year.

Accumulator—Case 1 (No Leverage)

Accumulator—Case 2 (2x leverage)